singapore gst rate 2018

The current rate of GST is 7. GST-registered businesses are required to charge and account for GST at 7 on all sales of goods and services in Singapore unless the sale can be.

Gov Sg How Much Will I Get In Gst Vouchers In 2018

Singapore first announced a planned 2 percentage point GST increase from 7 per cent to 9 per cent in 2018 but it was delayed due to the Covid-19 pandemic.

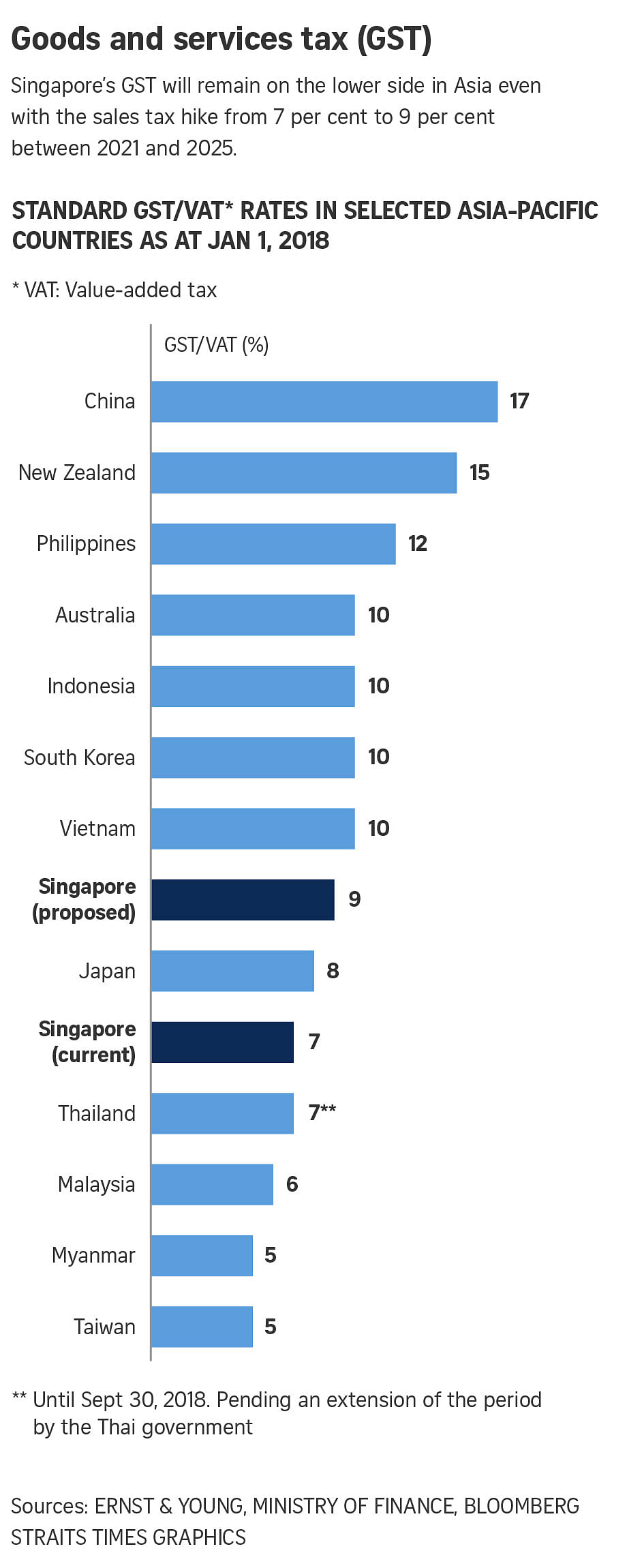

. The timing and approach of the GST rate hike have been much discussed since 2018. The present GST rate in Singapore is 7. This is compared to the global average standard VATGST rate of about 19.

GST RATE As announced in Budget 2018 the GST rate is planned to go up from 7 to 9 between year 2021 and 2025. They deduct GST from this amount that was paid on the purchase. I 7 to 8 with effect from 1 Jan 2023.

The FSI scheme accords concessionary tax rates of 5 10 12 and 135 on income from qualifying banking and financial activities headquarters and corporate services. This was increased to 4 in 2003 5 in 2004 and 7 on 1 July 2007. The Minister has now announced that the GST rate will increase from 7 to 8 on 1 January 2023.

The Government had announced in the. Ii 8 to 9 with effect from 1 Jan 2024. In Budget 2022 the Minister for Finance announced that the GST rate will be increased from.

GST Rate 1. Singapore announced a GST rate hike from 7 to 9 in 2018 but it has been deferred to sometime between 2022 and 2025 due to the COVID-19 pandemic. In the near future it will be raised to 9.

The GSTV comprises three components Cash MediSave and U-Save. Singapore first announced a planned 2 percentage point GST increase from 7 per cent to 9 per cent in 2018 but it was delayed due to the Covid-19 pandemic. The Singapore government has argued that reducing the rate of GST would benefit the wealthy more than the poor as the bulk of GST is collected from foreigners and higher-income earners.

Changes in GST Act due to Budget 2018 introduces the concept of Reversal Charge Regime and Reversal Charge RC Business. Several goods and services. Eligible HDB households will also receive an additional U-Save of 20 a year from 2019 to 2021 in addition to the regular U-Save amounts.

The current GST rate of 7 per cent in Singapore is amongst the worlds lowest even in the Asian region. RC Business is a person who is subject to reverse. Each business in the supply chain charges GST on sales.

With this in mind. GST was introduced in Singapore in the year 1994 3 which was gradually increased to 4 in 2003 5 in 2004 and 7 in 2007. When GST was introduced in 1994 the rate was 3.

What were Singapores GST rate over the years. At 7 Singapores GST rate is one of the lowest among the double-digit rates in many developed economies around the world. In Budget 2018 the.

This is necessary as the Minister foresee. More importantly the upcoming and much talked about GST rate hike from 7 to 9 announced in Budget 2018 affects all businesses whether GST registered or otherwise. The current GST rate in Singapore is 7.

Also known as Value Added Tax VAT in many other countries Goods and Services Tax GST is a consumption tax that is levied on the supply of. GST Changes in Budget 2018 -GST rate hike and introduction of GST on imported services GST rate hike from 7 to 9 sometime in the period from 2021 to 2025 Generally the GST rate. In total about 16 million eligible Singaporeans will receive a total of 1 billion worth of GST Vouchers and MediSave Top-Ups in 2018.

Singapore first announced a planned 2 percentage point GST increase from 7 per cent to 9 per cent in 2018 but it was delayed due to the Covid-19 pandemic.

Current Gst Return Due Dates For Gstr 1 Gstr 3b To Gstr 9 9c Due Date Dating Return

Gov Sg How Much Will I Get In Gst Vouchers In 2018

Gov Sg How Much Will I Get In Gst Vouchers In 2018

Diwali Cruise Singapore Bangkok With Costa Fortuna Nov 2018 Costa Fortuna Costa Cruises Cruise

Gov Sg How Much Will I Get In Gst Vouchers In 2018

Singapore Gst Guide For Business Owners Updated 2022 Piloto Asia

Pin By Meng Yeong On Information Philippines Bhutan Laos

Notice From Gst Department Top Reasons Response Timing Eztax In Accounting Tax Services Accounting Software

Northernlights Norwayinanutshell Norway In A Nutshell Northern Lights Norway Tromso

Gst Increase Here S How Much The Government Will Collect And How Much More Will You Be Paying

Statutory Corporate Rates Of Tax Around The Globe The Law Tree Corporate Tax Globe

1 Nov 2018 Budgeting Inheritance Tax Finance

Singapore Commits To Raising Gst In 2023 Amid Inflation Nikkei Asia

Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 The Straits Times

Who Needs To Register Gst When To Register For Gst You Must Register For Gst If You Carry Out A Taxable Activity And Your Turnover Was 60 000 Or More In Th

Singapore Tour Package 5 Days Singapore Tour Holiday In Singapore Singapore Tour Package

Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 The Straits Times

Gov Sg How Much Will I Get In Gst Vouchers In 2018

0 Response to "singapore gst rate 2018"

Post a Comment