company tax computation format malaysia 2017

Under SAS the burden of. Companies are taxed at 30 2017 2018 financial year.

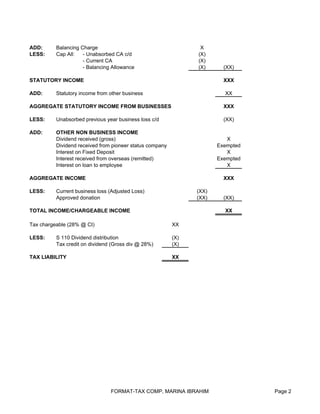

Company Tax Computation Format

PCB should be paid to LHDN by the 15th of each month for the remuneration issued for the previous month.

. Stamp duty Your company is required to pay for Stamp Duty when. Mulai Tahun Taksiran 2018 anggaran cukai. All local bank interest income is still tax exempted so that RM2000 local bank interest income doesnt count either.

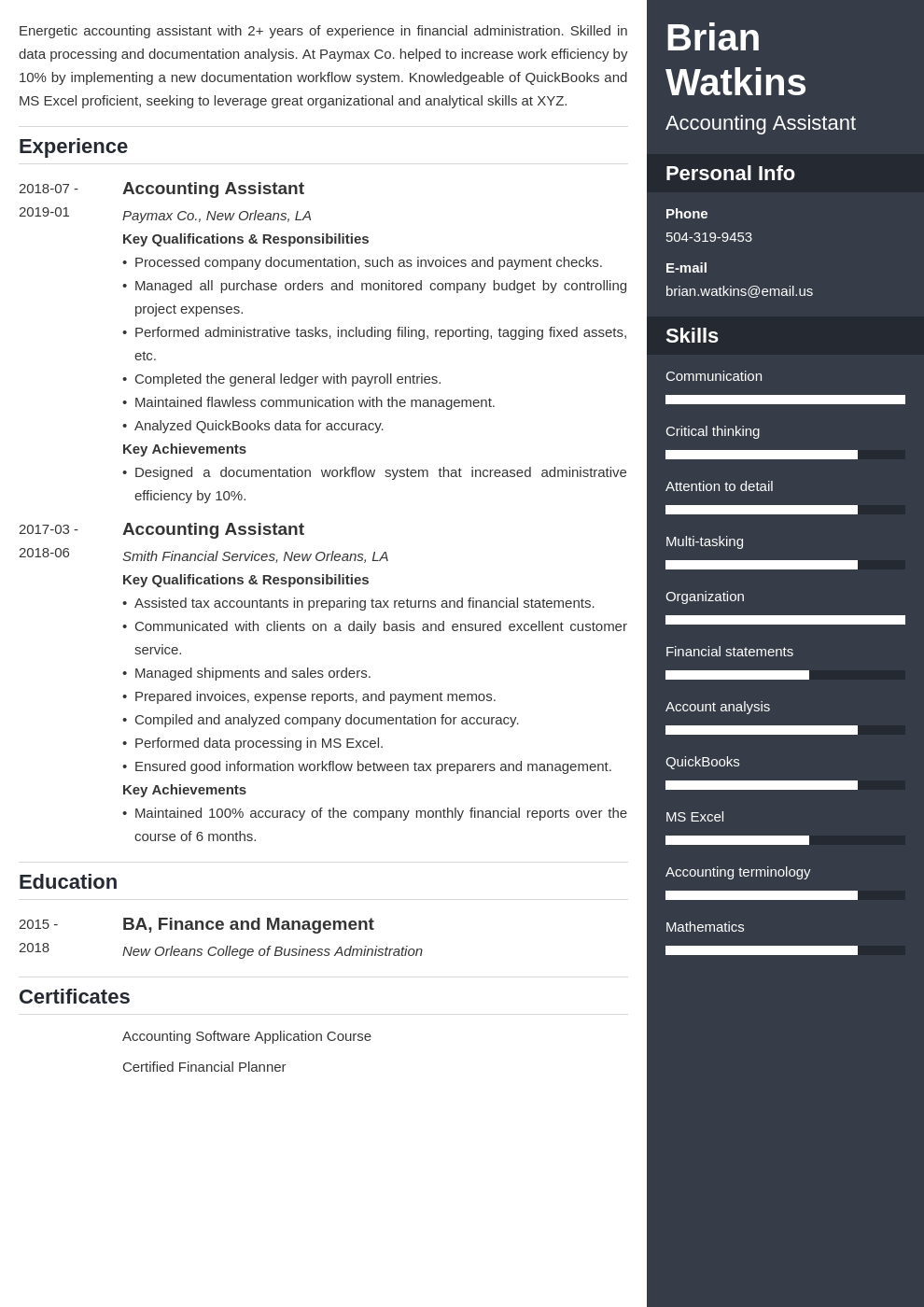

Profit before tax 2898 Notes. Not only are the. Computation of income tax format in excel for fy 2017 18.

Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale. If your company is filing Form C you must file its audited unaudited. A Malaysian LLP is required to submit the Estimate of Tax Payable Form CP204 and as a general rule.

Company with paid up capital more than RM25 million. RM000 Depreciation of plant and equipment 1400 Royalty fees refer to the details below. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are.

Your company should prepare its tax computation annually before completing its Form C-S Form C-S Lite Form C. By applying these exemptions and reliefs your chargeable income will. That means 30 of taxable income needs to be paid to the ATO.

An effective petroleum income tax rate of 25. Corporate income tax in Malaysia is applicable to both resident and non-resident companies. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Those who want to open a company in Malaysia as an LLP should know that they can. Najib said for example if a companys chargeable income for year of assessment 2016 is RM10mil and increase to RM12mil in year of assessment 2017 the income tax. The tax return is deemed to be a notice of.

Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company. Marina ibrahim Page 1 7102014 COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX. Company tax computation format malaysia 2017 The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent.

The Self Assessment System SAS of taxation in Malaysia has created challenges for companies in the area of tax compliance. Income Tax Rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Company with paid up capital not more than RM25 million.

Upon the completion of this period the company may be eligible to apply for the principal hub incentive scheme and receive a 10 corporate tax rate for a maximum period of five years if it. New Financial Year 2017 - 2018 or AY 2018-19 Cash Payments10000 are disallowed under Section 40 a In case of fixed assets CAPEX purchased in cash more than. 1 Cost of sales Included in the cost of sales are.

Company types that fall under this. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income. Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million On first RM600000 chargeable income 17 On.

You can also get a tax year overview. The form c is a declaration form for a company to declare its income whereas tax. Company tax computation format 1 1.

A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia. Tax rate Resident companies are taxed at the rate of 24. Hantar anggaran cukai secara e-Filing e-CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual.

Business Income Tax Malaysia Deadlines For 2021

United States Taxation Of Cross Border M A Kpmg Global

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

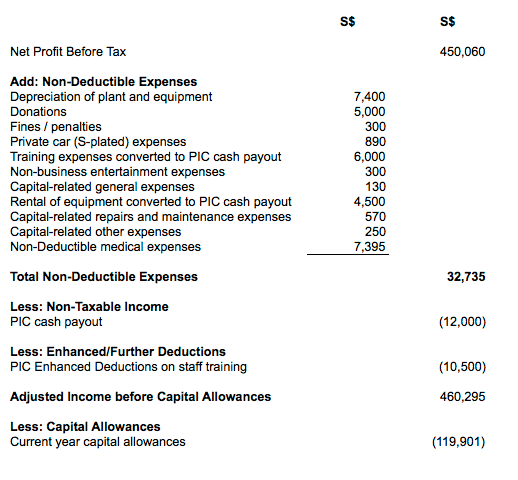

Accounting Assistant Resume Sample Job Description Tips

Tax Consultant Resume Samples Velvet Jobs

Company Tax Computation Format Malaysia 2017 Yahirctzx

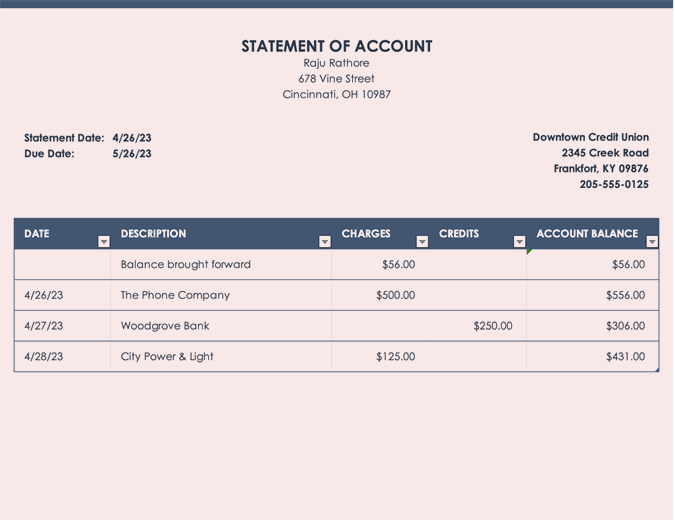

Analyzing A Bank S Financial Statements

Company Tax Computation Format 1

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Doing Business In The United States Federal Tax Issues Pwc

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Company Tax Computation Format Malaysia 2017 Yahirctzx

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

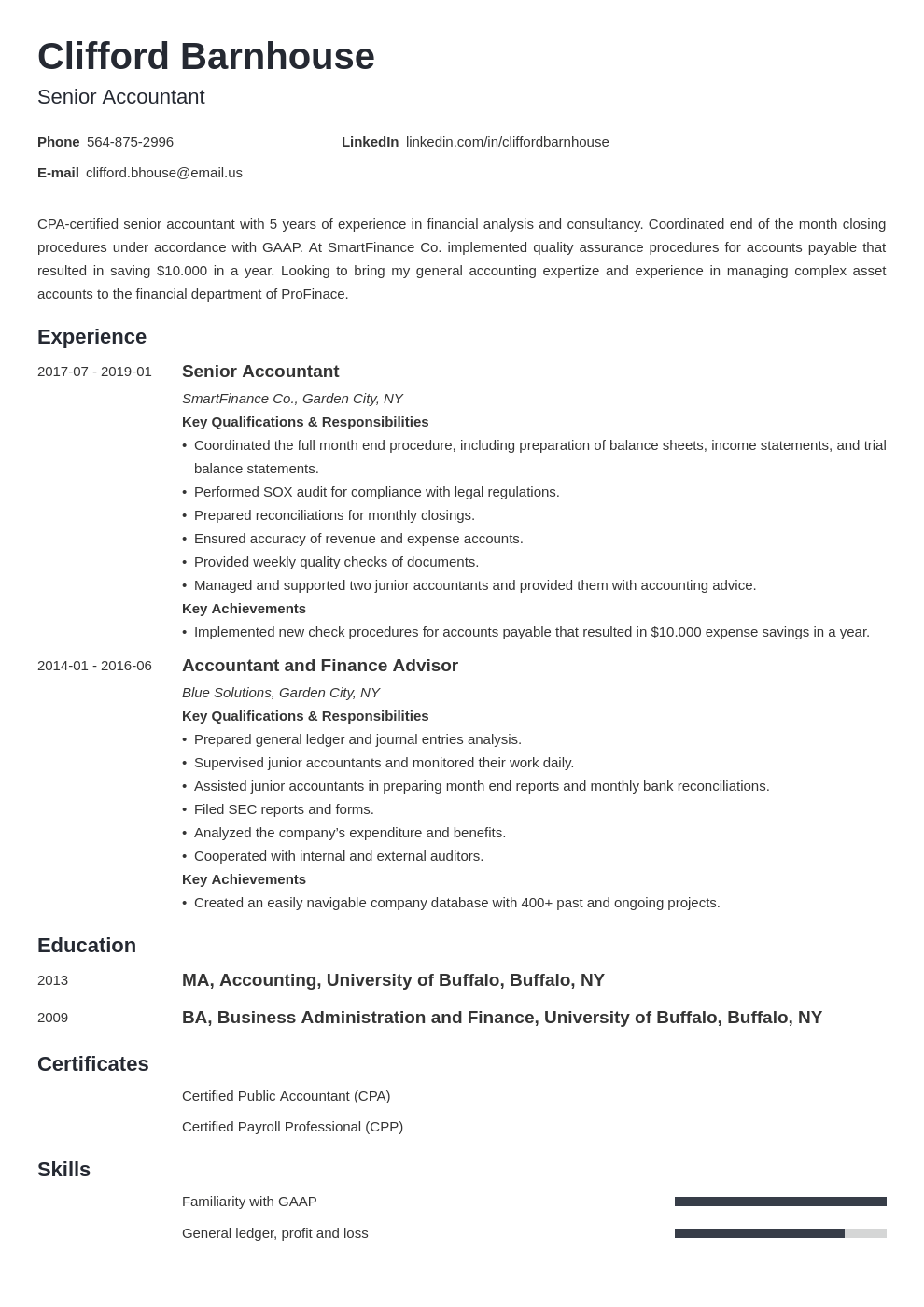

Senior Accountant Resume Sample 2022 Guide Tips

Corporate Tax Meaning Calculation Examples Planning

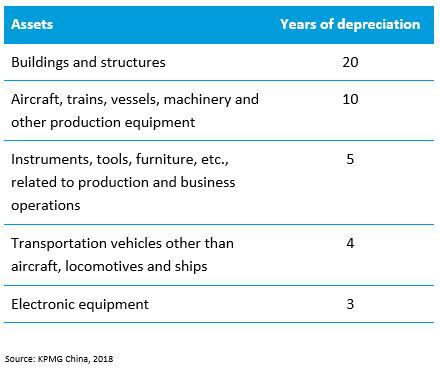

China Taxation Of Cross Border M A Kpmg Global

Format Computation Of Income Tax Payable For Companies Pdf Format Of Income Tax Payable For Companies Abc Sdn Bhd Computation Of Company S Tax Course Hero

0 Response to "company tax computation format malaysia 2017"

Post a Comment